2019 Income Tax Relief Malaysia / Individual Income Tax In Malaysia For Expatriates Offshore News Flash - Further, there are several tax relief schemes that residential.

Increase in tax relief to rm6,000 for medical expenses including fertility treatment. Generally, malaysia has used double deduction to incentivise taxpayers to incur certain revenue expenses. Deduction of tax from special classes of income in certain cases derived from malaysia 109 c. There are also differences between tax exemptions, tax reliefs, tax rebates and tax deductibles, so make sure you. malaysia income tax an a z glossary.

You make payment on income generated the previous year i.e.

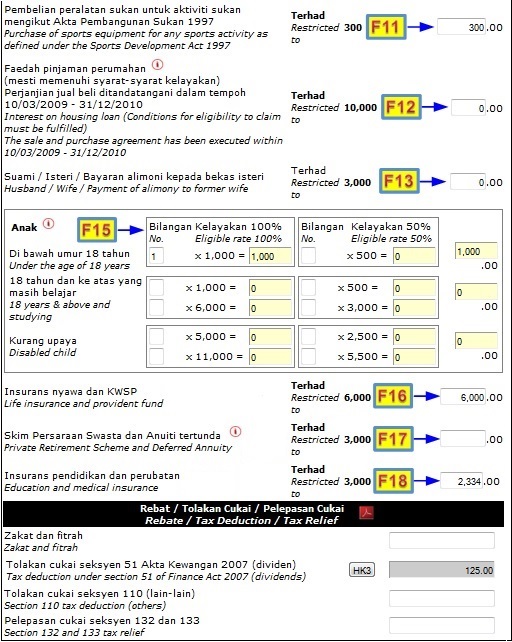

Deduction of tax from interest paid to a resident 109 d. Know the deadlines, charges and procedures. It helps taxpayers, to reduce a certain amount of money spent on necessities in a particular year — from your total annual income. Below are the individual / personal income tax rates for the year of assessment 2020, provided by the the inland revenue board (irb) / lembaga hasil dalam negeri (lhdn) malaysia. Everything you should claim as income tax relief malaysia 2020 ya 2019. The green investment tax allowance (gita) and the green income tax exemption (gite) will be extended until 2023. To help make things a little clearer, we run through the list of all items eligible for tax relief, with explanations for some of the more confusing entries. The relief amount you file will be deducted from your income thus reducing your taxable income.make sure you keep all the receipts for the payments. Excerpt of s154(1)(c), s132, s132a and s132b of the income tax act 1967 (laws of malaysia act 53) power to make rules 154. The system is thus based on the taxpayer's ability to pay. Simple pcb calculator is a monthly tax deduction calculator to calculate income tax required by lhdn, malaysia. The simple pcb calculator takes into account of rm2000 special tax relief limit that capped at income rm8000/mth. It's time to file for your income tax returns!

New personal income band for taxable income in excess of rm2mil to be taxed at 30% from 28%. 3.2 applications for the award of msc malaysia status and the tax exemption are to be submitted together in one application to mdec. Liam president anusha thavarajah said on friday the insurance body supported the separation into rm4,000 for epf and rm3,000 for life. Individual income tax in malaysia for expatriates. 24 september 2019 tax treatment of wholly &

malaysia's government has introduced several income tax amendments that will impact individual taxpayers for 2021.

You make payment on income generated the previous year i.e. Deduction of tax on the distribution of income of a unit trust 109 e. Keep in mind, the deadline for filing your taxes has been extended to end june due to the ongoing pandemic, so you better get to it soon before its too late. It's time to file for your income tax returns! Simple pcb calculator is a monthly tax deduction calculator to calculate income tax required by lhdn, malaysia. Personal tax reliefs 2020 malaysia. Prior to jan 1 2018, all rental income was assessed on a progressive tax rate ranging from 0% to 28% without any tax incentive or exemption. 3.2 applications for the award of msc malaysia status and the tax exemption are to be submitted together in one application to mdec. Filing deadline individuals who earn an annual employment income of rm34,000 above (after epf deduction) Nevertheless, as usual, taxpayers (employed individuals) have until. One of a suite of free online calculators provided by the team at icalculator™. The relief amount you file will be deducted from your income thus reducing your taxable income.make sure you keep all the receipts for the payments. Corporate income tax, or corporate tax, is a direct tax that is paid to the government via irbm/lhdn, it is governed under the income tax act 1967.

The 2019 income tax filing and payment deadlines for all taxpayers who file and pay their federal income taxes on april 15, 2020, are automatically extended until july 15, 2020. Monthly tax deduction 2020 for malaysia tax residents. See how we can help improve your knowledge of math, physics, tax, engineering and more. Personal tax reliefs 2020 malaysia. The green investment tax allowance (gita) and the green income tax exemption (gite) will be extended until 2023.

Once the income from overseas stocks is taxed in the origin country, it will be free from tax charges when transferred to the owner in malaysia.

10) order 2018 p.u.(a) 389/2018. The system is thus based on the taxpayer's ability to pay. Individual income tax in malaysia for expatriates. Personal tax reliefs 2020 malaysia. In tabling the supply bill (budget) 2020 in parliament today, finance minister lim guan eng said to encourage more. Malaysian income tax relief for your next year tax filing. 3.3 each application for the award of msc malaysia status and the tax exemption will be For disclosures made between 3 november 2018 and 31 march 2019: Excerpt of s154(1)(c), s132, s132a and s132b of the income tax act 1967 (laws of malaysia act 53) power to make rules 154. The maximum income tax relief amount for the lifestyle category is rm2, 500. Deduction of tax on the distribution of income of a unit trust 109 e. Deduction of tax from special classes of income in certain cases derived from malaysia 109 c. Malaysian should pay attention if their annual income more than rm34,000.

2019 Income Tax Relief Malaysia / Individual Income Tax In Malaysia For Expatriates Offshore News Flash - Further, there are several tax relief schemes that residential.. This relief is applicable for year assessment 2013 only. Deduction of tax on the distribution of income of a family fund, etc. In the past, this has been used to encourage spending on: Know the deadlines, charges and procedures. Under the special program, the reduced penalty rates for income tax, petroleum income tax and real property gains tax are as follows:

Post a Comment for "2019 Income Tax Relief Malaysia / Individual Income Tax In Malaysia For Expatriates Offshore News Flash - Further, there are several tax relief schemes that residential."